IWM 0.00%↑ - would’ve liked to see 222 serve as support on the break over 226 but it is what it is. I closed the November put hedges this morning around 220.73 (not quite a bottom tick) but I bought them > 226.3 so they provided a nice cushion on the recent PA.

If we get a daily close below 220, then I’ll look to exit my DEC calls and re-evaluate. I’m not one to “hope” for PA to correct.

I entered into NOV calls on 10/14 (see week ahead) near open and rolled the original equity into DEC calls at 226.5 so I’m still up on the position. I also recommended to hedge with some NOV puts (which I closed out near 221).

QQQ 0.00%↑ - Chopping on this July gap. I’d imagine it stay in this area until earnings come in. Remember earnings have been revised down so they’re likely to beat.

$SPX - views haven’t changed. Any move up is going to be on big tech moves.

Mon 10-21, Drop and back up

Tues 10-22 Gap down and move back up

Simple digestion (daily levels posted in my substack chat have been good).

JOBY 0.00%↑ - Original thesis here:

Got some news that propelled it higher; The monkeys are now officially chasing so we sit back and wait.

Week to Date changes in JOBY 0.00%↑

Not all of this will stick to OI but just posting this as a generalized update.

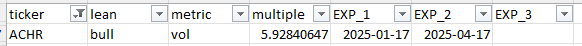

ACHR 0.00%↑ - Archer Aviation: Ready for Takeoff or Grounded by Turbulence?

If you missed JOBY 0.00%↑ or want to get a little more degenerate, then I present to you ACHR 0.00%↑.

Ok - realize this was a SPAC that got decimated and the chart looks awful. But… electric vehicle takeoff and landing is all the rage now (until tomorrow when teletubbies come back)

Archer is developing its flagship eVTOL aircraft, "Midnight," which is designed to carry up to four passengers plus a pilot for short flights of up to 60 miles. The aircraft aims to operate with minimal noise and zero carbon emissions, making it ideal for urban environments.

To all the JOBY 0.00%↑ snobs out there… you might have gotten a partnership with TM 0.00%↑, well…. ACHR 0.00%↑ has a partnership with STLA 0.00%↑ (wait… I don’t think that’s a good thing…. It’s Stellantis after all).

This trade is purely a momo trade so if you wanted to play it, 5.25 is a logical target with 3 as a stop

This is another SPAC darling that fell off a cliff after reality stomped on the hopes and dreams of SPACs - Chamath promised retail investors access to high quality IPOs…. (he wasn’t involved)

Option Flows

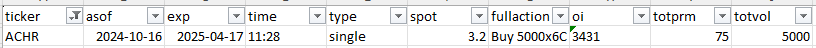

This triggered my option premium alert on 10-16 (I didn’t really think twice).

5000x April 2025 6Cs were bought at the ask along with 1200 January 2025 3Cs.

Well today, someone did this….

This trade was 13.5x larger than other trades.

There was also decent volume on a spattering of dated calls

2026 7Cs

2025 3.5-5Cs

2026 5Cs

Are you a leave bucket of candy outside type of unc or answer door type?