Just wanted to put some thoughts together as we approach FOMC and it appears there’s quite a bearish echo chamber across Fintwit.

Market Action under the hood

S5TW - % of stocks Above 200D MA

SPX is just under 1% off the highs while % of SP500 stocks above 200D is down quite a bit into the 38s.

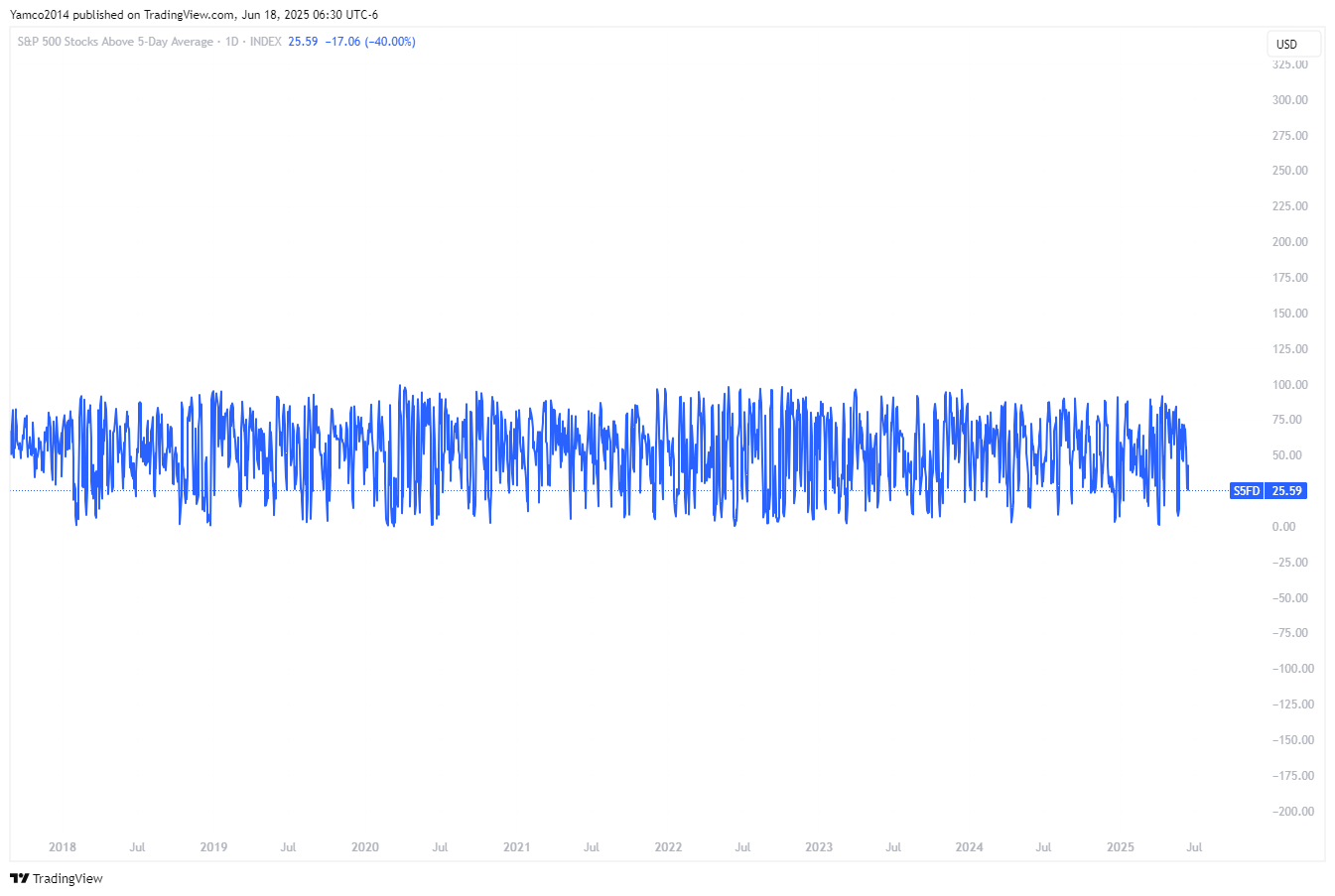

S5FD - % of stocks Above 5D MA

You would think SPX should be down 3-4% from the highs with how low this metric is.

One can easily deduce that the metrics above are because of low concentration of s tocks moving higher while the rest of the market retreats.

Let’s take the past 1 month of SPX and look at the 1M performance of the following sectors in SPX

XLF - FInancials

XLE - Energy

XLRE - Real Estate

XLI - Industrials

XLP - Staples

XLK - Technology

XLB - Materials

XLV - HealthCare

XLY - Discretionary

XLU - Utilities

Key Takeaways - XLE (Energy) and XLK (Tech) are the only two sectors to beat SPX.

Let’s dig into XLK…

One can simply look at the Semis ETF (SMH) against MAGS, SPX, and RSP and see that the semiconductors are leading the chart the past month

SMH is the main driver of Tech’s out performance as MAG7 is just slightly over the SPX performance.

An interesting statement from JBL 0.00%↑’s CEO on their earnigns call yesterday.

A few tickers I’m monitoring

ATH Dwontrebd Break and flagging on declining volume

Breaking out over this 18 month S/R Zone… I’d like to see a look above and backtest to confirm it’s not a false breakout.

Final observations on Market Structure

CPC - Total Put/Call Ratio overlayed with SPX

The Yellow Lines are there to annotate times when we saw a sudden surge in Put/Call Ratio - I just noted a few lines in the past year that generally showed a point I was trying to make.

Relatively fast VIX Spikes to SPX

We know VIX is a recursive calculation to the cost of 30 day option pricing. It should be no surprise that when volatility (VIX) spikes quickly and nothing happens, that the volatility unwind pushes market ever higher.

SLR

Yesterday Afternoon, we got a headline about seasing of SLR for banks. This in essence is private QE. By adjusting the risk requirements of banks, you’re in essence creating an environment for economic expansion on the backs of bank lending.

Consider a bank where normally they need some large value of reserves for lending and you reduce that reserve… We know banks generally push the limit to their lending risk so now you open up the possibility for them to take on more lending risk and make more $$$…

So what

Market internals have generally pulled back into FOMC and OPEX. Strength in the market is generally tied to a few sectors/tickers. Market has quite a bearish lean given CPC and VIX. Market needs a reason for volatility to remain bid. Be very careful subscribing to geopolitical risk as a crash source or any other narrative. Until we get through FOMC (get dot plots), and make it through Quarterly Opex, remain nimble and the most painful action would be a sharp rally to melt bear’s faces.

Thank you Yam.