Systematic Update and the Path forward (09/24)

This is a mid-week update I’m continuing from the latest article

Seasonality is in focus and “The Crash is NOW!”. Well.. we covered the “increasing Put skew” that all of Fintwit was ranting about in the 09/11 update (Pasted below)

Well… where did the left-tail risk go? I can’t fully discount the idea we get an exogenous vol event that sends us down 200 pts, but let’s look at a few data points and see if the seasonality bears are right again….

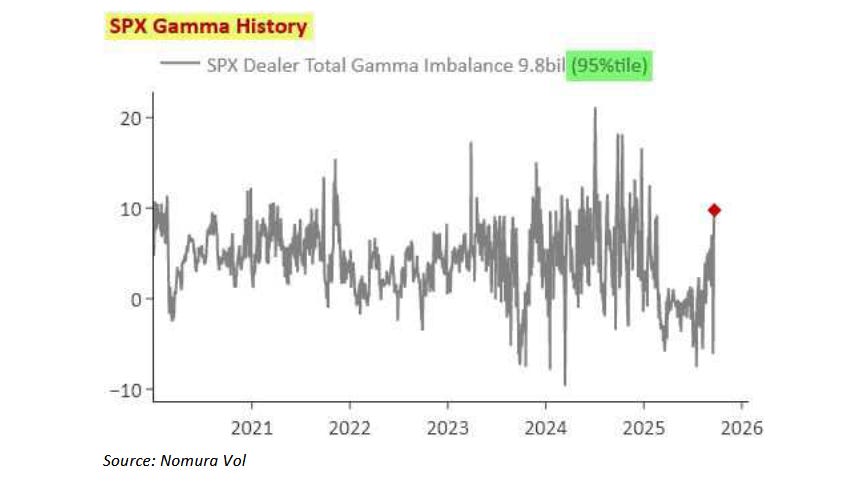

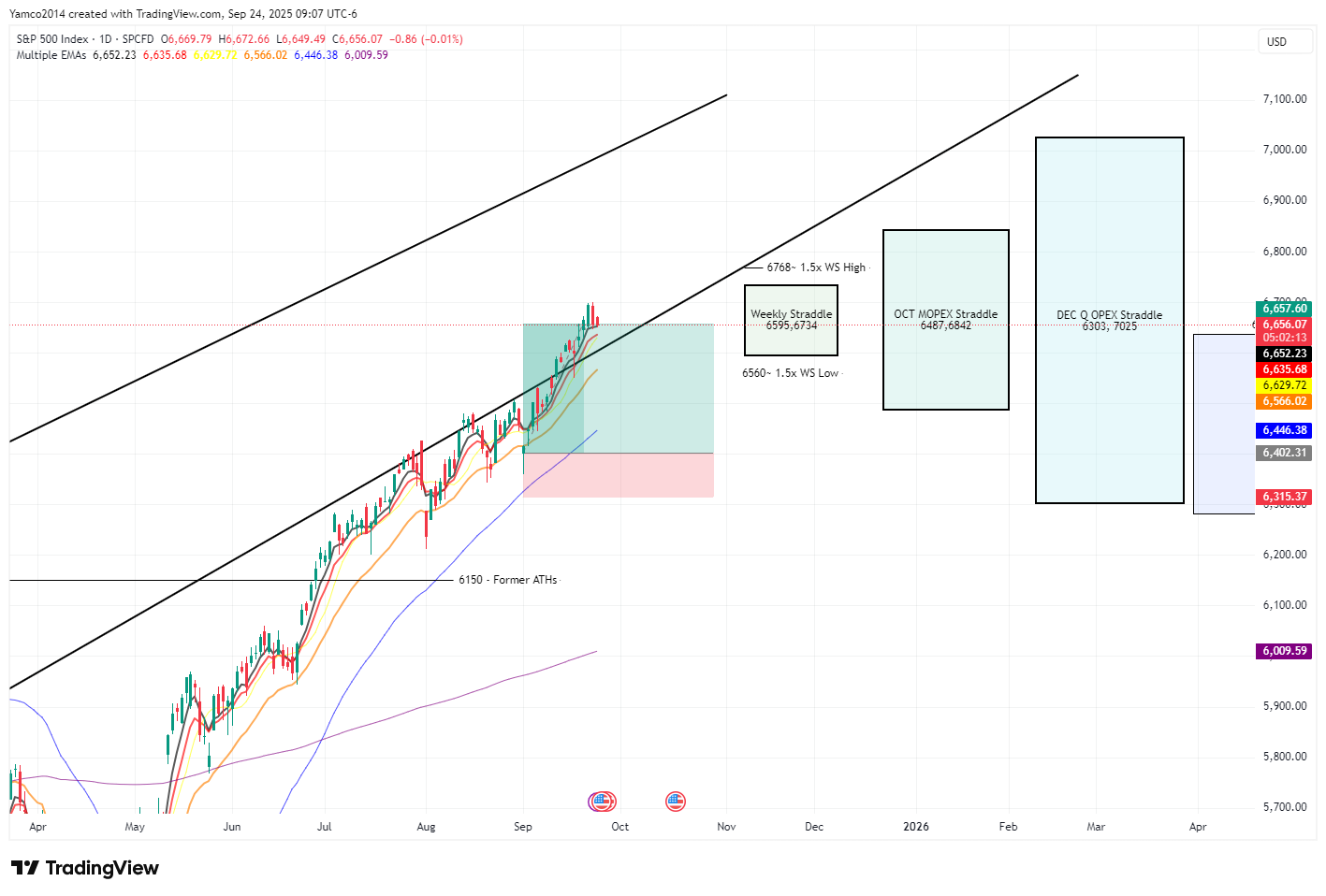

SPX Gamma

Gamma at high relative values - Remember this high positive gamma particularly as Realized volatility remains under Implied Volatility suppresses prices to the downside - It’s ultimately a cushion .

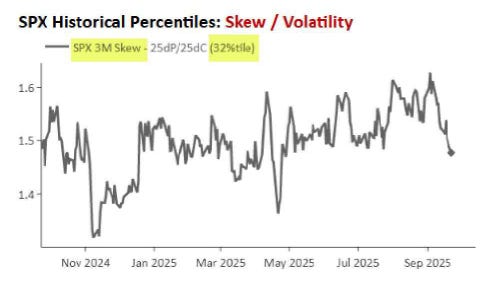

3M Skew

Just 3 weeks ago, everyone on Fintwit was highlighting put skew at the 95th+ percentile and seasonality crash was imminent so buy all of the protection (I think hedges are a requirement if you’re an extremely long beta book - Cash is also a hedge FWIW). I have some DEC puts that are down but they’re there to absorb an exogenous event vs play speculative downside.

Anyone want to guess how the current 3M skew has shifted?

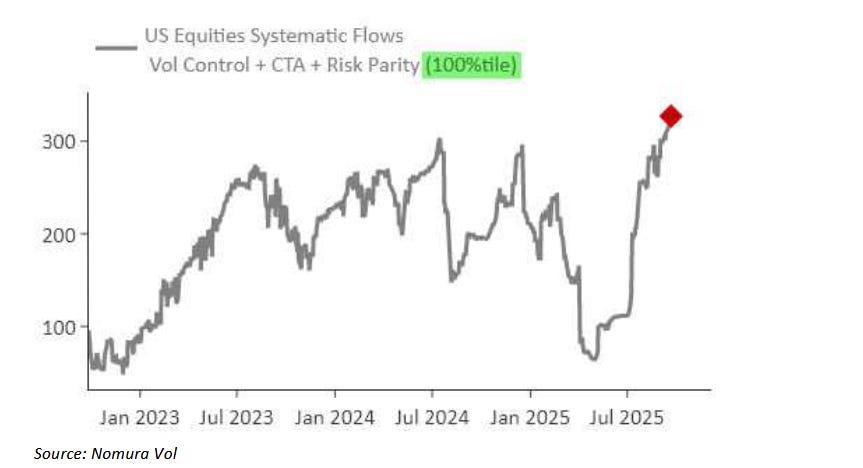

It’s shifted in favor of the right tail into year end. As we end the “window of weakness” into next week (Yes I know seasonality bears will mention October as another weak seasonal period), we will begin to see some systematic leverage flow into the system - remember I’ve been talking about vol control funds the past 3 months, anticipated the possibility of a turn around Labor day and made it clear that without a sharp uptick in realized volatility, the grind higher will resume after Labor Day. As I’ve covered and eluded to, these systematic strategies are stretched with AUM near relative exposure highs.

However a simple scan of the research available shows these systematic funds use leverage around volatility which I’ll cover later.

Vol Control Funds

If you remember all of the information I’ve presented in the past 3 months on this subset of systematic funds, they’re going to be the first to exit the door if we get a sharp rise in volatility followed by CTAs if we breach ~6400/6450.

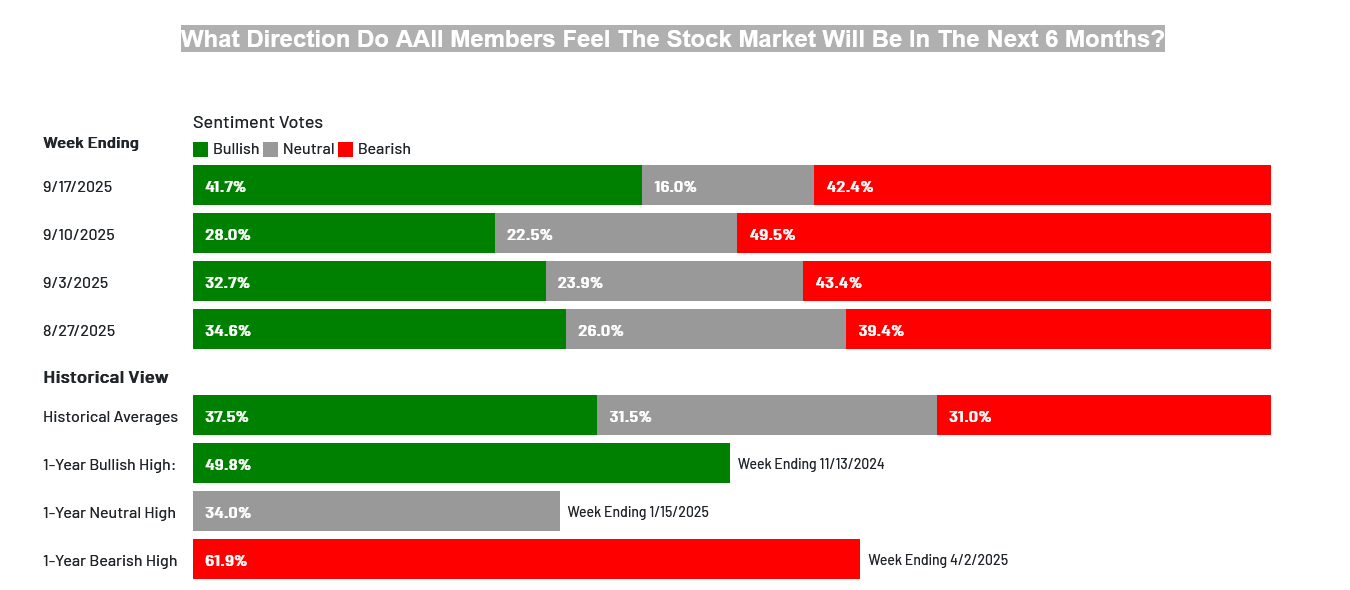

Market Sentiment

This is the AAII sentiment from last week but the point still stands… shifts in sentiment are something to track as respondents got bullish late last week as we ripped higher into Quarterly OPEX and are facing this currently catastrophic 70pt dip.

Sentiment is driven heavily by macro events.

So let’s dive in….

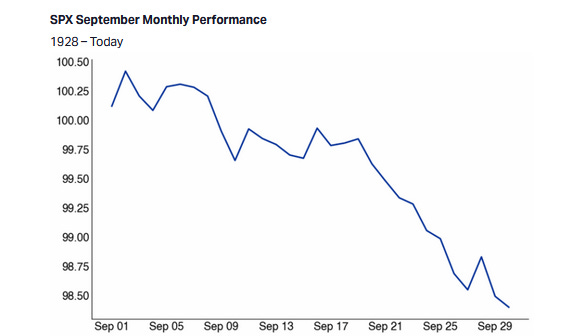

Where do we stand in terms of “seasonality”

Well…. If you invert seasonality, it looks like bears won by a factor of almost 3

We’re currently up about 3% in the month of September. I know, just wait….

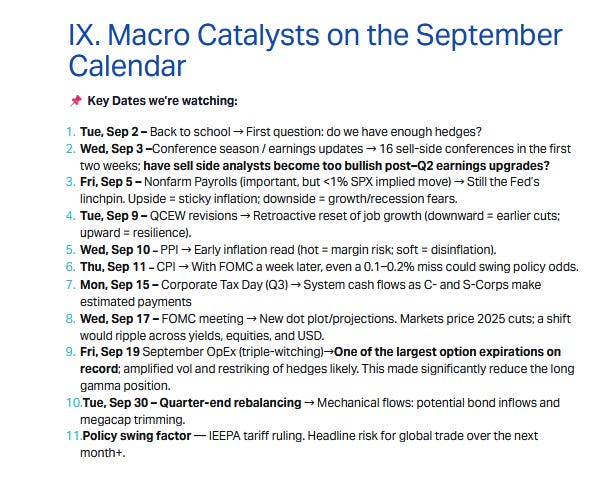

Where do we stand on Macro Catalysts?

Now to the more nuanced updates…..