Splitting up weekly review and week ahead into two separate articles

General thoughts on this week

This week, there have been a few headline moving events as follows:

CPI ~ Cool and fade

PPI - Cool and nothing

Iran/Israel Escalation/Bombings Fall, deadcat bounce, fall (ongoing)

The market has remained in BTD mode this week… I noted this in the past week ahead here: https://yamtrades.substack.com/p/positioning-and-week-ahead-06-09

Weekly Review

This week was ruled by dip buying.

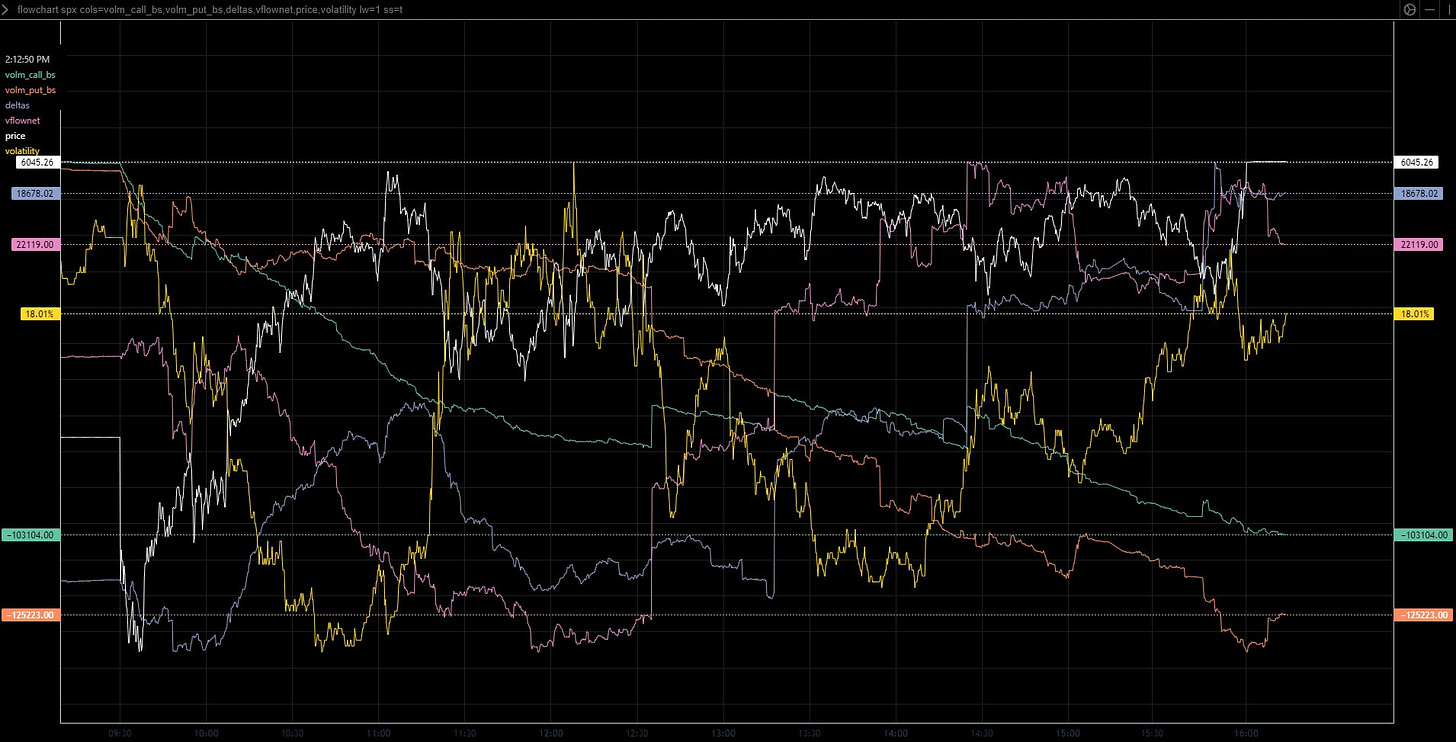

I’ve started tracking the flowchart for the day and linking the flow chart dynamics back to the price action for the day.

Orientation for these charts

SPX Price - White

VIX - Yellow

Volm_put_BS - Orange

Volm_Call_BS - Green

Deltas - Blue

Vflownet - Pink

(Volume of Call Buys + Volume of Put Sells - Volume of Call Sells - Volume of Put Buys)

It’s basically Green-Orange

Monday

Premarket Gameplan

Plays

None Taken

General Market Commentary

Today was a pure chop fest centered around 6000 with very little action in the index. From the premarket note, 6000 and drift up was mentioned as a play (I was not interested in taking it). However this was the correct play. My general take is the options positioning for the day was generally net dealer long - the limited upside short gamma was closed short after open.

Flow Chart

Deltas up throughout the day.

Both calls and puts Net Sold across expiration dates - Volatility selling remains front and center. CPI and PPI this week.

Tuesday

Premarket Gameplan

Plays

Two Adhoc Plays posted in chat

Around 11am EST, I posted the following chart and said "we're generally in this band of support and could sell sharply if we move down". I took no position here - Not my style to short smaller ranges even thought there is great money trading like this. This trade took about 30 minutes to materialize and we saw a SHARP sell into 6000 that rebounded into a new ~2 month high at 6035.

I posted this breakdown under 6025 and said Ideally we get a move down to '22, a pop over '25 into '27 and then sell - This is my IDEAL price action as it shows me that sellers are officially in charge. I chased the breakdown from 6019.5 and sold most in the lower teens. I ended up getting stopped on my runners at BE as I was hoping for a continued sell down.

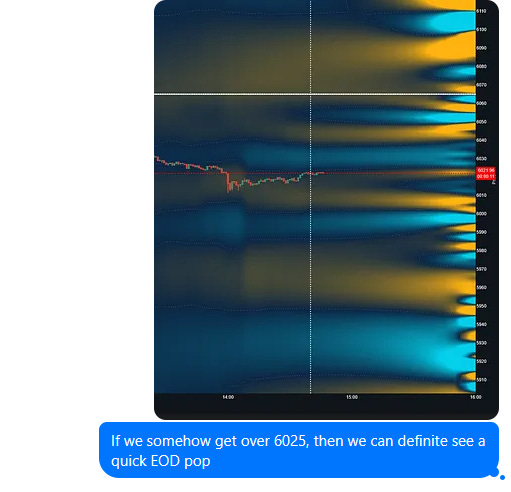

As we got to 6021-6022, I posted if we get over 6025, then we get an rip higher (I entered this trade at 6028 as posted). I took my profits on ES at 6035 and 6040.

Market Commentary

The day started with a small gap up and grind into 6020-6022 which was identified as a short area if you wanted an intraday short area. I personally did not take it - I'm more a BTD or shorting breakdowns. The 6020-6022 short worked for a scalp range a few times if you took it.

After the morning grind up, we saw a sharp gap down to 6000 and rebound to DS high before selling off again and ripping back above the DS high.

The majority of this PA was just options driven dynamics.

Flow Chart Review

Deltas grinded up basically all day (reminder these are transactional deltas across expirations)

Oscillations in SPX were largely driven by changes in VIX

There was a small pop in put buys before the EOD fall.

Wednesday

Premarket Gameplan

Plays

There were two BTDs Identified on Wednesday which I just failed to execute.

6050 > 6040 BTD was identified in Premarket …. However, I did not take the trade because I did not get a backtest and the market ripped 20 points higher….

The 2nd trade I called out in chat was a look into the 6025/6030 Support Cluster to go long… Market bottomed on that candle just under 6030 and ripped higher to 6055.

I took two smaller attempts at range expansion over 6050 and got stopped on each. These were called out as small in size as I was generally looking for delta to pay me and wasn’t willing to put much capital at risk hence the tight stops.

Market Commentary

The Premarket CPI Pump failed to hold as we generally moved up to 6070 on the release and opened at 6050 before selling off into 6030 before making our way to 6060 and starting the 6030 bounce again before moving up into the Bond Auction. At 1341, there was news surrounding Israel/Iran and the PM selloff began from there (couldn't breach 6000). As this sell off happened - A member in the chat noted the large 6010 dealer short puts (market Net Bought) and those along with the 6020 puts generally capped moves back up.

Flow Chart Review

Generally saw Deltas climb during the day and fall a bit towards the backhalf of the day as options were generally net sold across expirations. The sell off in the afternoon happened well before SPX deltas started to follow [See White Box].

Thursday

Premarket Game plan (this came out after PPI)

Plays

Identified Trades that didn’t pan out.

1) 6000 BTD was ID'd while we bottomed just under 6004. Generally the right idea but execution was off.

2) 6025 Buy the dip - We got a Iran/Israel headline at 1124 EST that was a near instant buy. We did get a small backtest to 6027 but my general lean was Buy the 6025 to use a 3 pt stop under that eventually ran to 6040 (it initially wicked to 6035 before testing 6027 and moving up to 6040).

The only trade I took today was a 10W 0DTE Butterfly at 6060 which didn't work out. The general idea here was positive gamma + supportive charm should grind higher. The market pretty much did nothing after putting on this trade.

Market Commentary

This day was an absolute chop fest!!! I had 2 Buy the dips identified.... and didn't get into due to small deviations in Price or extremely fast PA.

Flow Chart Review

Transactional Deltas generally ended at the high of the day while vflownet (net calls - net puts) ended at the high of the day. My inference from this is puts were more net sold than calls - team BTD.

Friday

Before I begin the daily overview, I want to explain why I really hate trying to force a trade after post headline days. We normally get a series of confirming headlines, conflicting headlines, and everything in between. However I put one trade one and called out some other ones in chat.

Premarket Game plan

Plays

I took a small 5940/500 0DTE put spread and closed for a small loss. I called out it was up 60% which marked the bottom.

Market Commentary

The market had a large spike down on escalation in Israel/Iran Thursday afternoon and a deep BTD Overnight at 5925

Flow Chart

The flow chart shows that deltas moved up nicely mid morning before cratering. Volatility is hovering at the highs into the weekend.

Next week (First 3 days)

Wide purchased straddles for 6050 and 5900. Remember one side will likely win big out of this weekend. I will not speculate which side wins.

OPEX

Large Synthetic Short at 6000 and a 15k Put Credit Spread at 5975/5950.

I don’t really have any thoughts on PA since it’s 100% dependent on headlines

I watched the dead cat bounce to the original breakdown (hindsight).

Price is going to ultimately depend on 5925 then 5850 then 5750.