Looking into next week, we have CPI, PPI, Retail Sales, VIXEX, and OPEX this week.

All times are in EST

Sunday

China Imports/Exports (2300)

Monday

China GDP (2200)

Tuesday

CPI (0830)

Bowman (0915)

Wednesday [VIXEX]

UK CPI (0200)

PPI (0830)

Industrial Production (0915)

Crude Oil Inventories (1030)

Beige Book (1400)

Williams Speaks (1630)

Thursday

EUR CPI (0500)

Retail Sales (0830)

Philadelphia Fed Manufacturing (0830)

Initial Jobless Claims (0830)

Business Inventories (1000)

Daly Speaks (1245)

Friday (OPEX)

Housing Starts + Building Permits (0830)

Michigan Inflation Expectations (1000)

How significant are these events?

Well, we can use the straddle pricing to see the general jumps in pricing. See below

Positioning into the next week

I’ll go over each topic and summarize how I bring all this together at the end.

If you have any questions on these topics, check out the positioning article linked below

I added some general explanations of my scanner to the Review of Positioning Metrics (Keeping everything in one place)

Topics covered

Straddles with 50/70 percent ranges

15/25/40 Delta Skew by Date

Term Structure

Sentiment

Net positioning (Aggregate and by day)

Technical Structure of the Market

Cross Asset Observations

Key zones to watch

Putting it all together

Straddles with 50/70 percent ranges

Let’s look at next week’s straddle

The straddle for this next week is ~79 pts (1.27% straddle). The largest increase in the straddle is on Tuesday (07/15) The disparity in 25 delta call/put has fallen a bit from last week. We’re seeing about a 20% spread on the 20 delta costs while 15 deltas remain 50+% higher (a pretty normal occurrence).

The 78 straddle gives us a weekly straddle range of [6180,6339]

I’m keeping both the the July and Quarterly OPEX straddles below (Note: These are from June Opex Close)

July OPEX Straddle Range = [5755,6180]

SEP OPEX Straddle range = [5576,6360]

If you look at the two larger timeframe straddles above from the June straddle, you’ll notice that the weekly straddle low gives us the July OPEX straddle High and the weekly high generally gives us the Q OPEX High.

If you take a look at the inner values in the straddle snapshot above, you’ll notice the inner blue/yellow values representing 25 delta calls (yellow) and 25 delta puts (blue) are favoring puts/

The outer blue/yellow values represent the additive distance of the 15 deltas for puts and calls.

The 70% Range for each day(or week) can be obtained by adding the two yellow and two blue numbers together and adding the yellow sum to the spot price to get upside range while adding the blue sum to the spot price to get downside range.

Quick example (for this week)…

Let’s compare the 70% range derived from the 15 deltas to the straddle…

70% range: [6135, 6350]

Straddle: [6180,6339]

The disparity here between the 70% range and the straddle is actually pretty small given how the past few weeks have looked.

Skew

Orientation of charts

15 delta = top (OTM) and is often the place for speculative upside/downside. It’s a bit wingy but not quite as wingy as a 5 delta.

25 delta = middle (slightly less OTM) and is often the relative delta for hedges

40 delta = slightly out of the money and is often the relative delta for directional moves

Explanation of data in charts

Gray = ATM volatility (general demand in volatility)

Yellow = Call volatility

Blue = Blue volatility

Red = Skew

Observations

ATM Volatility has the sharpest move into Tuesday and then has a steady climb into end of week. The width of the difference in various delta IVs are explained by their general use.

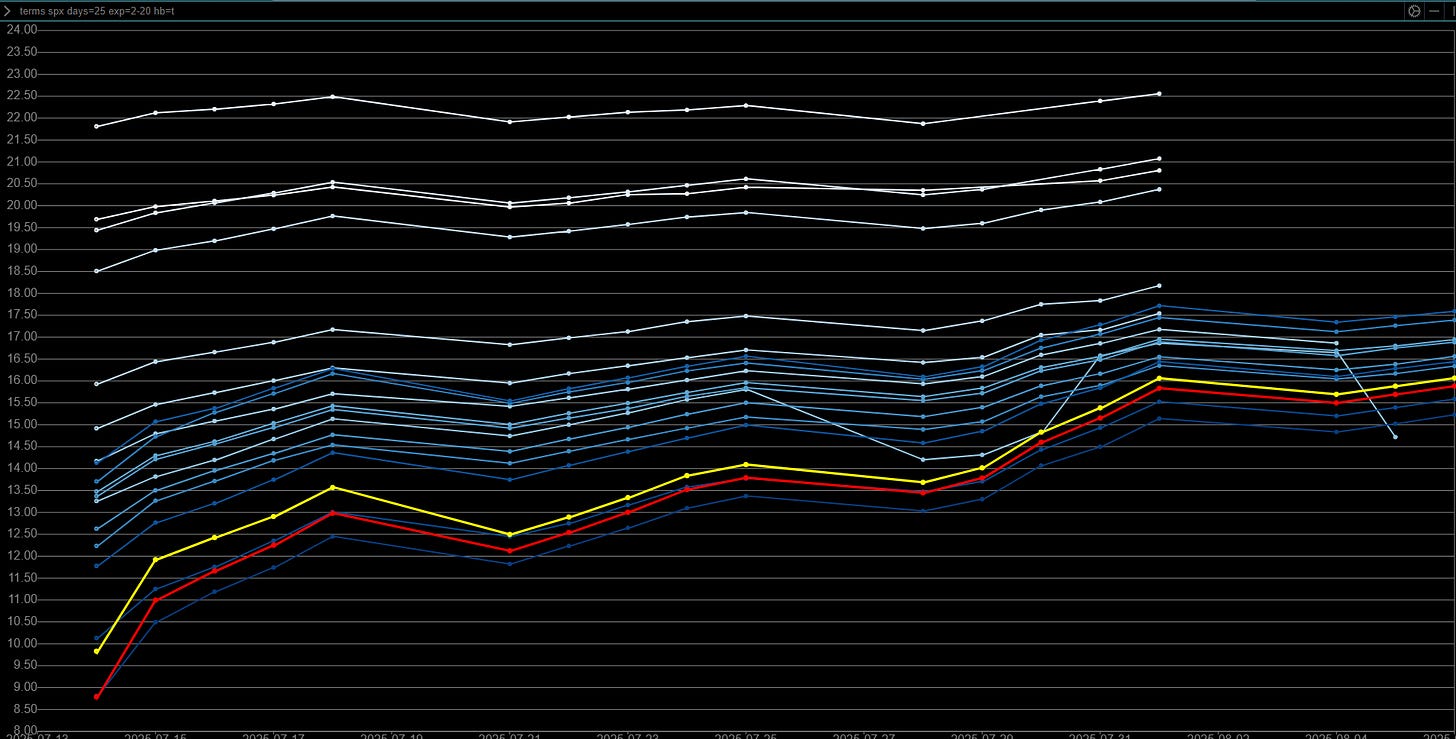

Term Structure

Term structure is still at the bottom of the range for volatility expectations moving forward. It has been slightly lower in the past few days but the difference is negligible.

Bearish sentiment capitulated at the highs….

Sentiment

Going back to February, the Bears have maintained a higher sentiment outside of one blip around June 11th.

Net positioning (Aggregate and by day)

Aggregate

At the OI view, Calls are slightly higher than puts. Much of these OTM calls are premium harvesting (sold calls). Sold calls are not bearish as they’re often sold to provide some hedge to their portfolio (harvest upside volatility premium).

From left to right

OI - Simple OI from Friday morning (just to show magnitude of positioning).

Volm_BS - Today’s volume aggregated by buy/sell

Orientation

Blue = Put

Yellow = Call

Above X Axis = Net Bought

Below X Axis = Net Sold

Volm - Today’s aggregate total volume

Net Dealer Exposure

Let’s dive into the net dealer exposure for Mon-Thurs next week.

Orientation

This graphic represents the MM (market maker net view).

Green: Calls

Blue: Puts

Red: Net

Left: Dealer Short (Market net bought)

Right: Dealer Long (Market Net sold)

General observation is vol control is out in full force - Any downside move looks like it will need to be headline triggered and likely bounces. There were some sizable call buys at 6300 for Monday (3500 net dealer shorts) but those could just be a hedge to a short position over the weekend or Barron could know a great press release is coming over the weekend!

The OptionsDepth Depth View Chart (see below) gives you the same aggregate look but with an additional temporal aspect.

The Depth view above shows Monday through EOM.

Orientation: This graphic represents the MM (market maker net view).

Red: Dealer Short (Market net bought)

Green: Dealer Long (Market Net sold)

Technical Aspects of the Market

Before I cover key zones to watch, let’s look at some technical aspects of the market.

Orientation

Each of these charts shows the past 4 years of the indicator

The purple line is the 200DMA of this indicator

I like to monitor a few technical indicators that show the percentage of stocks in the SP500 above their moving averages. I’ve also included the “total market” aspects of the longer duration metrics.

S&P Stocks above 200D average (S5TH)

Current reading is 59.56, down slightly from last week’s 61.23. This indicator’s very slight move down seems completely normal since the delta in the SP500’s weekly open to close is basically 0. We saw breadth expansion and this past week we got alot of consolidation which is healthy for the market. This is important to note as outside of a brief blip around May OPEX, the % of SP stocks over their 200MA has been below 50% since March!

Percent of Stocks above 200-Day Average (MMTH)

53% of all stocks are above their respective 200D moving average - down a bit from SP500 stocks over 200D. The SP500 gets the flows and we’ve seen a few high flying stocks suck liquidity out of the market as they push ever higher.

S&P Stocks above 50D average (SF5I)

Current readings is 67.33 down from last week’s reading of 78.5. This metric shows a large portion of the market is above the 50D. This metric shows a strong market under the hood. Also of note, This indicator has generally peaked over the past 3-4 years around this level but has room to continue higher with positive headlines.

S&P Stocks above 20D average (S5TW)

Current reading is 67.92, down from last week’s reading of 80.31. On a shorter time frame, we’re seeing quite a bit of consolidation (slight corrections) as markets cool off from the run out of June OPEX.

S&P Stocks above 5D average (S5FD)

The 5D average metric is very noisy and oscillates sharply but is down quite a bit from last week’s number indicating on a very short time frame that the market has consolidated and reset a bit of the momentum.

Across time frames, the various indicators are showing the market has undergone a consolidation of price over time (Just look at the delta between the weekly open/close).

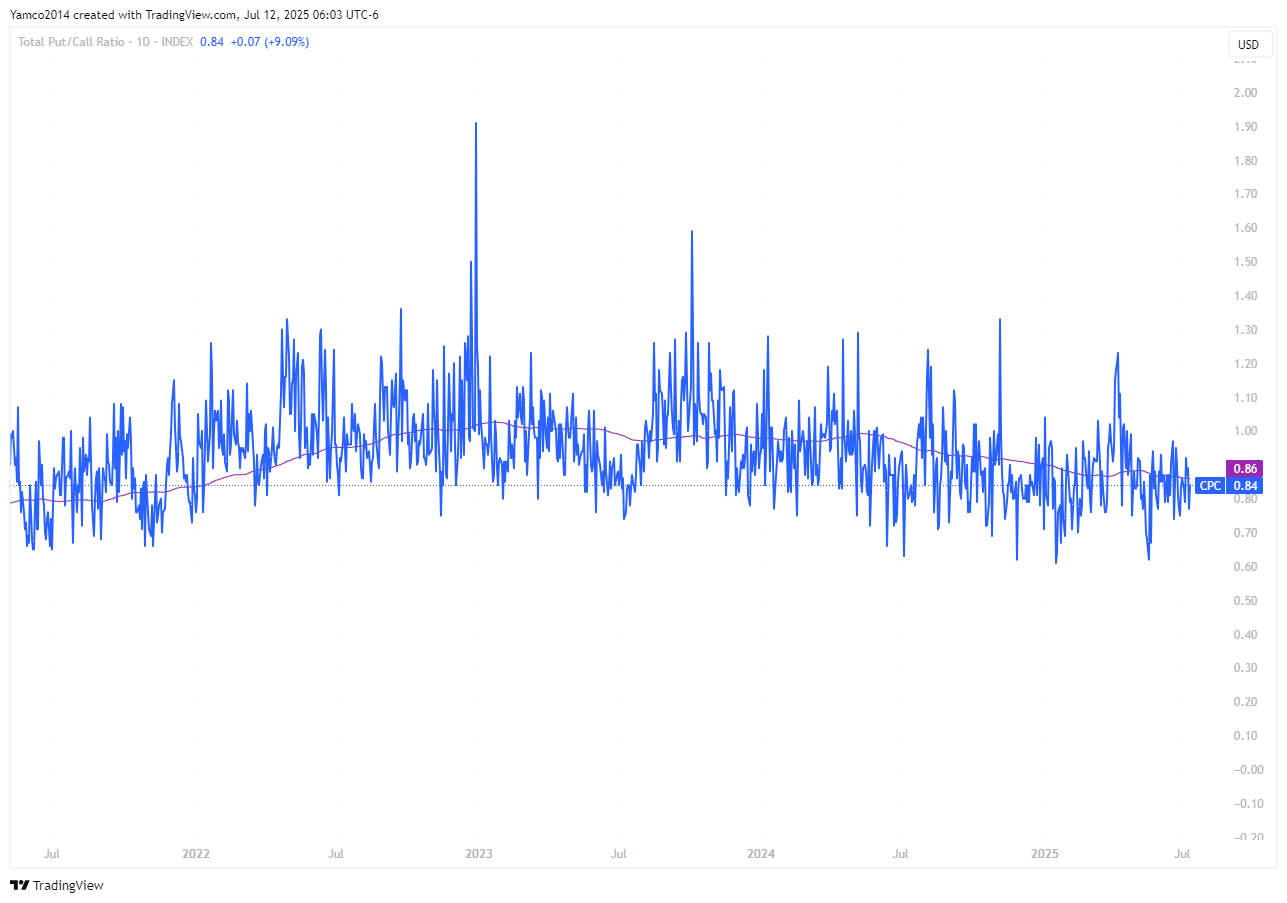

Total Put/Call Ratio (CPC)

Current reading is .84 up from last week’s reading of .79. This metric is often portrayed as an “imminent crash is incoming” when it gets low. I like to look at it simply to see the ratio between the two and see how it compares to price action. I mentioned last week that this market would start moving up as participants started to buy puts since we’re at ATHs and that’s what happened.

Entropy

This is a model built by Machina Quanta ( https://substack.com/@machinaquanta?utm_campaign=profile&utm_medium=profile-page) that captures the disposition of market pricing across time. This model shows entropy has moved down off the highs and is flat lining currently. I highlighted the window around May OPEX where we saw a similar drop off into May OPEX.

Quick reminder on what entropy represents

When most people here entropy, they think of disorder/chaos - that's the literal

lack of order or predictability; gradual decline into disorder.

Entropy was actually used for finding anomalies in EEG readings for cardiac patients. It could detect anomalies (because EEG charts are cyclical) where patients were about to have an imminent heart attack with good accuracy. It comes from the field of signal processing and information theory. It looks for changes in patterns and where a pattern diverges (it doesn't need to be cyclical pattern though...it could be non-cyclical, like an interest rate keeps rising until it blows up the country like Turkish Lira 20 yrs ago). Since, you're a math guy: the math equation is (we use a different variant) -sum[ p(x) log(x)]. <- this is basically, sum up a distribution of finite buckets.

where,

x = the state

p(x) = what proportion of participants are in this state

So, we have a bunch of states - in our case slices of market participants. Some market participants are short a lot, some are long a lot, some are neutral, some are a little short, some are a little long...imagine a spectrum of 10 investors views.

Normal market (each 'state' has a normal or maybe uniform distribution of views) - high entropy, there's no signal as things are going smoothly (i.e., the EEG looks normal, the person is healthy, their heart chart pattern is behaving exactly as it should - no heart attack)

**Distribution of market participant views below**

Normal market

[0.1] [0.1] [0.1] [0.1] [0.1] [0.1] [0.1] [0.1] [0.1]

Abnormal market

[0.7] [0.25] [0.05] [0.0] [0.0] [0.0] [0.0] [0.0] [0.0]

Abnormal market: distribution of states have almost all shifted to one side. In what market scenario does correlation of assets and market views go to 1? The EEG analogy - wow there's a burst in the cardiac chart or wow the amplitude of their readings is much lower than it should be...something is off with their heart. What happens after this is heart attack generally or some physical ailment.

CBOE VIX Volatility Index (1 month forward volatility of VIX)

The 30 day forward volatility of VIX (Vol of Vol) is starting to inflect up slightly. If this continues to rise after VIXEX (Wednesday), we might see a bit of volatility come to the surface. I bring this up as OPEX/VIXEX unpins and resets both volatility and positioning.

RSP v SPX

Market cap SP (SPX) v Equal weight weighted SP (RSP)

If you note something here…. the equal weight to market cap weight move in the index is generally remaining steady at 3% gap give or take for the past 2 weeks which shows that broader market is participating at a near equal pace. If this gap remains similar or closes, the market can continue its climb higher.

Cross Asset Observations

BTCUSD

Discussed this a few weeks back and wanted a flush - I botched the add in the red zone (I really wanted that green zone)

Silver has broken out of a quite a big consolidation pattern (nearly 1 year).

On a higher time frame, GLD 0.00%↑ looks to be consolidating for yet another big move. It’s about 2% away from breaking this consolidation pattern which its been in for the past 3 months.

Key zones to watch

In no particular order, we have a few big zones on the chart to watch.

First…. We’re in an environment of high volatility driven by headlines so these levels are going to be wide

From low to high:

5800: China Tariff Pause Gap

5850: EUR Tariff Gap

6000: Post Election NOV highs

6020: Post June Opex Flag Breakout

6050: Post FOMC early Jan Swing High & weekly 8EMA

6100: Lower level of ATHs

6150: ATHs & daily 21 EMA

6230: Daily 8 EMA

6285-6300: Bottom of Channel from October 2023

Let’s Put these on the chart with the 3 straddles (Weekly, Opex to Opex, QOpex to Qopex)

I’ve highlighted a box of confluence with Weekly Straddle high, This rising channel we’re approach (after losing it in February/March and the next Quarterly OPEX straddle.

Each of these identified levels is a guide to price action to watch into the next week.

They might each cause an extreme response as a squeeze might accelerate or a new sell off might begin.

Tie it all together

Straddle pricing has stayed relatively subdued while 25 Delta pricing discrepancy contracted a bit from last week as we go into VIXEX/OPEX week. There’s quite a bit of economic data this week and we’ve seen that tariff announcements are largely being ignored (a function of vol selling). The economic data this week will likely give the market clarity around rate cut expectations in July and September.

Term Structure shows the market has low volatility expectations going forward for the next week(s). It is slowly increasing but it’s pretty normal to see volatility expectations to rise with time.

Net options exposure continues to look supportive as Vol sellers are front and center across puts and calls.

Entropy is a bit off the YTD highs with some smaller oscillations which could indicate concerns around a small market pull back. I will note that as long as volatility remains subdued, the market will continue to remain largely supported and buy the dips will continue.

Technical environment shows that the market has undergone a bit of consolidation as the 21EMA caught up from 3.5% under spot to now 2% under spot. Since June Opex, the market has generally surfed the 5/8 EMA up and any sharper moves off these moving averages have corrected slightly to these averages.

As a general risk barometer, BTCUSD has been unleashed this past week. SLV 0.00%↑ has always confirmed a breakout.

Summarizing the above, the market is near key technical levels (Rising Channel + SEP OPEX high) while positioning and volatility will unpin after their respective positioning. Economic data releases will be key this week as FOMC is next week. There is a major announcement with Russia early this week (President said Monday) and rumors abound around what it could entail (mostly oil and sanction/tariff related). Any news on the EU or China Tariff front will likely be the near term catalyst to move the market. For now, any pullbacks looks poised to continue a move higher into the end of month - likely in yet another “V” pattern.

On to the position updates, and trades I’m watching.

Keep reading with a 7-day free trial

Subscribe to Yamco to keep reading this post and get 7 days of free access to the full post archives.