Splitting up weekly review and week ahead into two separate articles

General thoughts on this week

This week, there have been a few headline moving events as follows:

Peace Treaty in Middle East

Large gapup Monday evening

PCE

Market is looking forward to the cuts!

These two events saw us finish nearly 90 pts above the weekly straddle (nearly twice the weekly straddle!).

Quick Review of the big picture price action

Here were the levels I thought mattered. The week started off with a small move higher, small corrective push into the lower 5940s before immediate recovery (Monday’s Price action was fun to play - Check out the play by play review here:

I played Monday very conservative with some EOW Put spreads and could have played more aggressive but the setup was seen ahead of time on both the flush under 5990 and the recovery.

After this small bout of volatility, the market broke out of a flag and immediately gapped and ran higher every day. We had cleared the weekly straddle by Tuesday’s close and kept tracking higher. We ended the week at the June to July Opex straddle high. For what it’s worth, I feel like tracking the expectations for these periods gives me great insight into market expectations. Obviously when we get resolution to a bid in volatility, we’re going to move higher on that volatility bleed off.

Each day after Monday involved gap ups, grinds, and some very minor corrective action before the dip was bought. These weeks are hard to play intraday due to the permanent bid that prevents an A+ entry for an intraday swing. However…. the EOD pins have been quite lucrative in terms of % gains on setups.

I wanted to note to all that I prefer to trade 1-3 quality setups a day versus chasing PA even if I have a general read on price action. I’ve found in my time as a full time trader that fewer pre-planned quality setups have treated me better than constantly trying to chase PA during the day. I do my best to call out observations I see in the data.

I’ve started tracking the flowchart for the day and linking the flow chart dynamics back to the price action for the day.

From last week’s week ahead….

I had a little bias going into this next week that we would see a bit of sideways, and a move down to the EOM collar beginning of week before continuing our trek higher. Turns out…. the corrective phase just went back to the early June 5940’s before lift off…

$BTCUSD did indeed have small correction (103 > 98), but it was bid back to 105 by end of day Monday. I was eyeing some IBIT 0.00%↑ calls for reversion back up into August Opex, but wanted to see a bit of a consolidation lower but we got an immediate V recovery - The move surprised me!

USD tried to have a counter trend rally and immediately failed on FOMC members expressing their belief we could have a July rate cut.

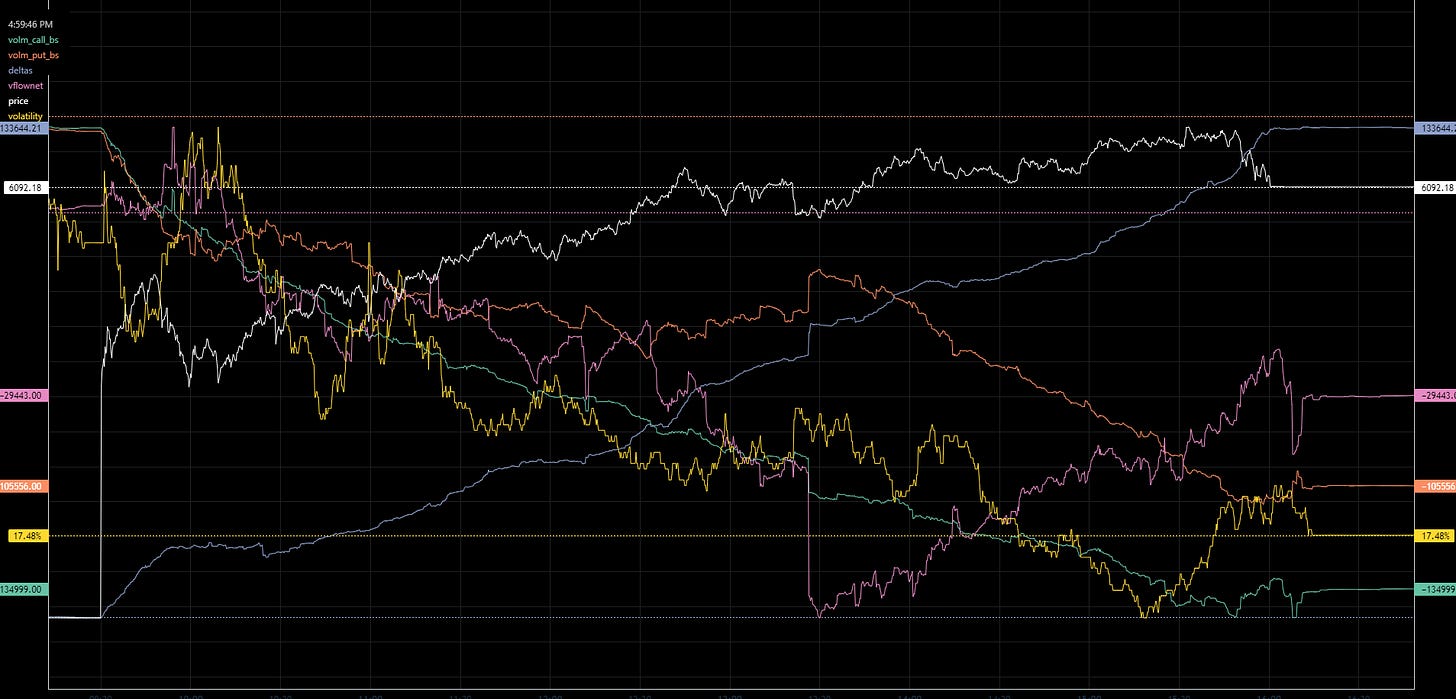

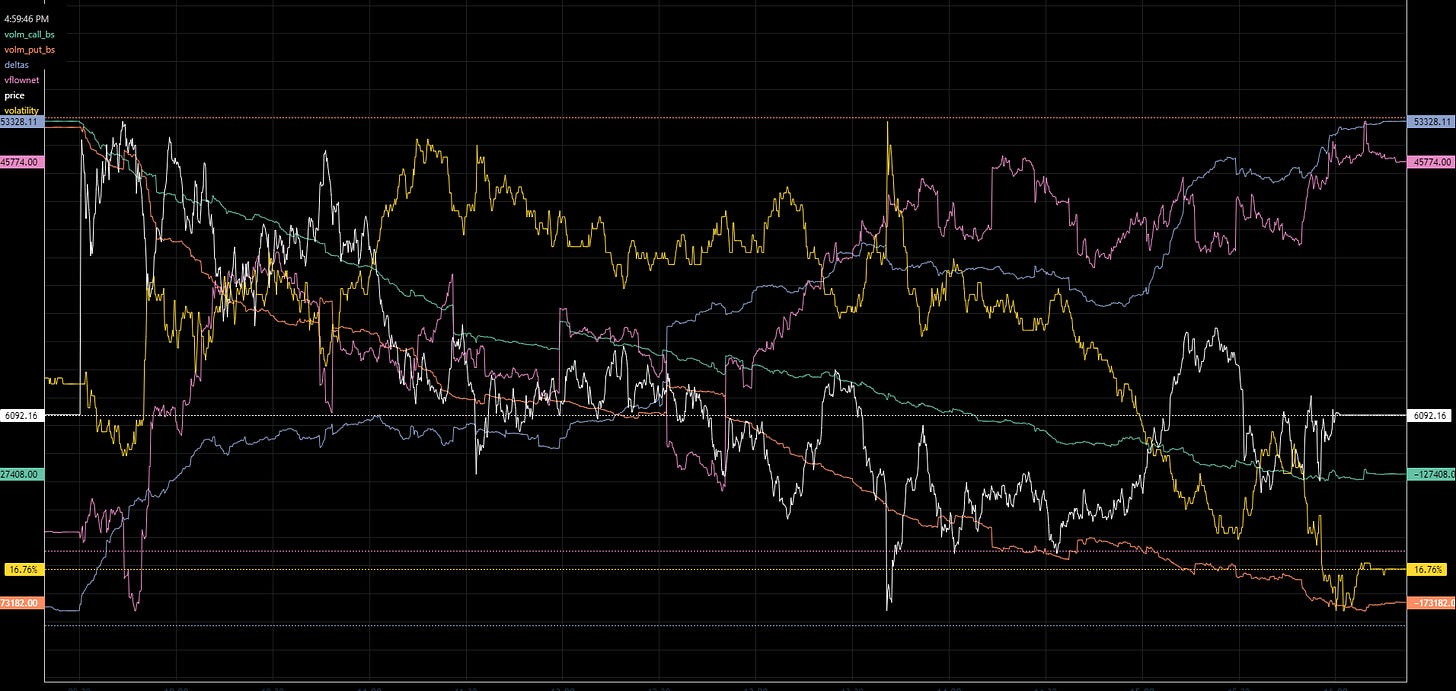

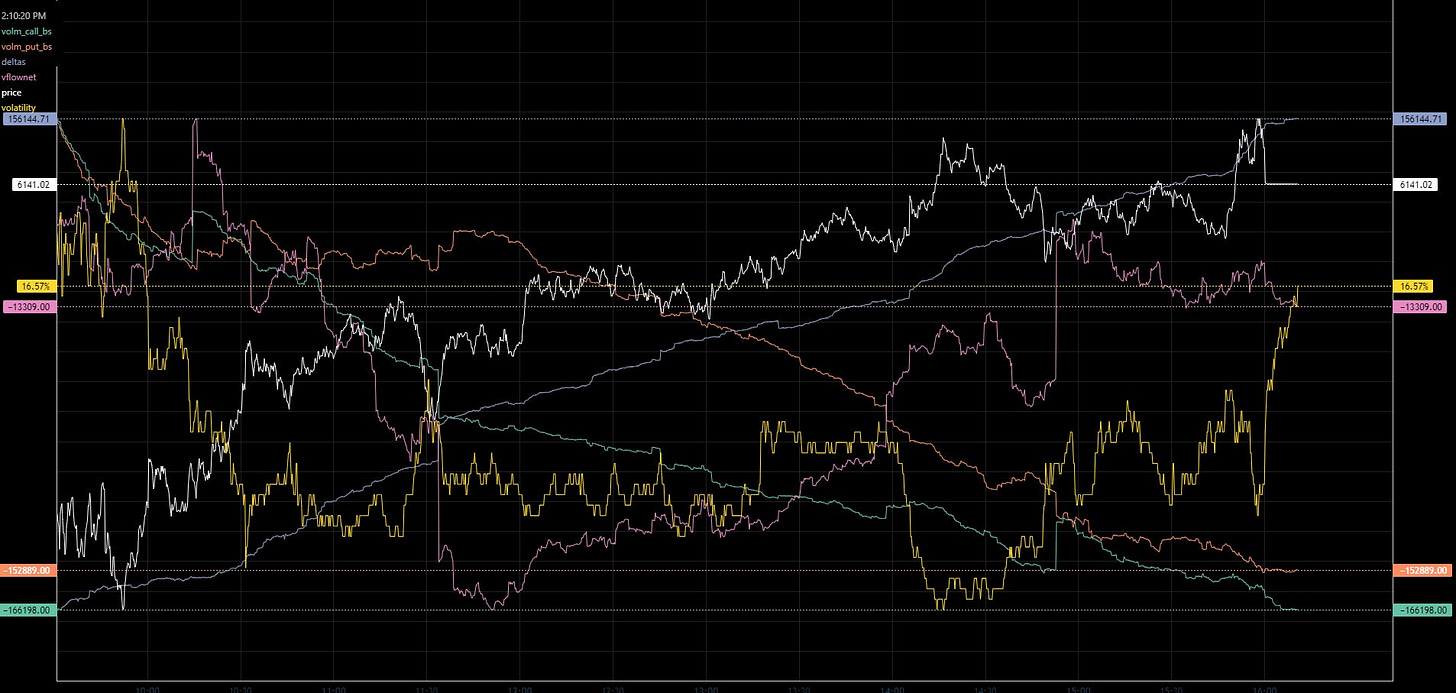

Orientation for these charts

SPX Price - White

VIX - Yellow

Volm_put_BS - Orange

Volm_Call_BS - Green

Deltas - Blue

Vflownet - Pink

(Volume of Call Buys + Volume of Put Sells - Volume of Call Sells - Volume of Put Buys)

It’s basically Green-Orange

Monday

Premarket Gameplan

The Premarket Gameplan had the general idea of STR with some BTD opportunities but Price Action gave us a different setup.

Plays

General Market Commentary

Market immediately ran higher towards the DS high before losing steam. We got a pullback under 5990 into our target of 5955 (overshot quit a bit) and BTD went into effect ending above the daily straddle.

The entire day was called out in chat and worked out pretty well for those that followed along.

Flow Chart

Deltas moved up in the first part of the morning before rolling over and plunging hard on the loss of 5990 while Volatility spiked. Volatility then melted while SPX deltas climbed back up to the highs. Note that QQQ and SPY deltas stayed on the floor which is an interesting divergence to note.

This climb in deltas shows the market is continuing to look for a move higher.

Tuesday

Premarket Gameplan

Plays

Officially, I saw nothing of quality, but on the side I did a few small 0DTE call spreads using that gameplan above but they weren’t particularly good trades - They were small 0DTE call spreads [think small 5W call spreads] targeting 6100 which I don’t really announce because RR wasn’t there….

Anytime, we’re above the daily straddle, trades in my opinion aren’t generally high quality trades because we’ve exceeded the market’s expectations for the day.

Market Commentary

We got a gap up last night on a peace treaty and the market just grinded higher after a small AM pullback. The gameplan from this morning was 6050 > 6085 > 6100 which worked out with baby blips throughout the day.

Flow Chart Review

The deltas more or less climbed all day without pull backs - This is normally indicative of a grind higher and indicative of vol control funds selling options as we climb. If you notice, we saw large volumes of net sold calls and puts - Watching the joy SPX module, most of the Call sells are further OTM while the put sales are generally closer to ATM giving us the move in deltas higher while both are net sold.

Wednesday

Premarket Gameplan

Plays

I had a play identified at 6080 and the move down and bounce higher was so fast that I missed the trade.

I had called out in chat that based on the options profiles, we would likely end flat from the move to 6080… I know a few members took that trade - These intraday setups require very timely entries to make the RR of taking the trade worth it. I’ve recently been doing 0DTE call spreads given how low volatility remains and how mechanical the market has been acting.

Market Commentary

Wednesday was our first day this week with any red price action as we saw a small gap up and fade of 20 pts before recovering to end flat. The gap down was a press release of how SLR might be adjusted for the future.

Flow Chart Review

Flow chart saw a steady climb in transactional deltas while price drifted down. This is indicative of a market that will buy the dip off any structural support - which is exactly what happened during the day. We tagged 6080 and bounced (the bounce was only 15 pts).

Thursday

Premarket Gameplan

Market Commentary

We got a gap up, a 10 pt pullback and then grinded higher all day. The dealer exposure showed us how price action was leaning and it did not disappoint.

Plays

I took an EOD butterfly discussed in chat for a double which paid nicely with 0 drawdown.

These days aren’t really filled with opportunities but the 6110 recovery in the opening half hour was a missed opportunity. As per the game plan/dealer exposure above, “above 6110 and 6120 then 6140”. I was eyeing a test of the pivot to get long which would have been a really great play.

Flow Chart

Continuous climb in deltas throughout the day with small oscillation in volatility that moved market a bit. There isn’t really much to say as every day this week is climb higher in deltas while options are net sold.

Friday

Pre market game plan

Plays

I took some 0DTE call spreads for a few hundred % and an EOD butterfly as I left the desk a bit early and covered it from .45 to 1.45. Nothing really done in size. The game plans posted in the morning this week have generally been how price has reacted.

The best play of the day was the afternoon flush to 6140 (I stated I wasn’t interested in buy the dip because of how transactional deltas were looking but did call out the 6150 pin play. Let’s take a look at when I had to leave the desk for my daughter’s summer play and what the flow charts were showing after that callout.

Market Commentary

Gap up, drift above daily straddle high (and a smaller move higher before reversion off a Canadian Tariff comment by Trump back into the daily pivot and we ended again at the daily straddle high.

I’ve discussed the Buy the dip market and this week did not disappoint - these grind markets are hard to trade as entries are less than ideal and 0DTE spreads are the best bang for your buck as the outlay is small and risk/reward has been the best. I’ve transitioned back to trading options as VIX has finally retreated into the teens.

Flow Chart

Steady climb in transactional deltas supported the intraday grind higher. On the vol spike form the Canadian Tariff announcement, saw saw SPX deltas fall while QQQ and SPY deltas reach a much lower low of the day. I left in the white box when I said I don’t think I''d buy the dip but I did call out a 6150 pin. As soon as I stepped away, deltas turn back upwards and Vflownet (differential in net call/buy volume) surged. Those two data points would have given me confidence from 6147/6150 to press some bigger trades for that 20+ point move higher.

See the snapshot below showing SPY (top) and QQQ (bottom)

I marked the starting delta on the Y axis with a white line and showed the relative bottoms with a white circle… If you notice, they showed a much larger drop off from the delta peaks which I attribute to retail traders thinking it was time to short while SPX (institutional traders) didn’t see as large of a relative drop.

Next week [EOM/EOQ (Monday)

Monday is the EOM and let’s see how it’s shaping up.

Note, IC trader is back with 10k ICs at 6130/6125 (puts) and 6200/6205 (calls).

If you notice, you’re only seeing the 6205 dealer short call leg because there have been 10k 6200 calls sitting there for the majority of this past week.

Tuesday through Thursday

What sticks out to me here is the large upside at 6200-6300 and supportive downside. Each of the 50 pt intervals have large concentrations but let’s walk through these concentrations

6200: 6955 short calls, 3960 long puts (fuel to go higher)

6150: 4200 short calls and 5200 Long puts (supportive)

6100: 5200 short calls and 3000 long puts (supportive)

6050: 3700 short puts and 2000 long calls (breakdown area)

As we go into NFP (Thursday), the market is prepped to scream higher on what I’d imagine is bad data is good because that solidifies cuts are coming

It just depends on how bad is good and how bad is bad….

Looking forward to the next week with you all - let’s crush it.